Things about Baron Tax & Accounting

Table of ContentsWhat Does Baron Tax & Accounting Mean?Get This Report on Baron Tax & AccountingExamine This Report on Baron Tax & AccountingThe Facts About Baron Tax & Accounting RevealedThe Main Principles Of Baron Tax & Accounting

And also, bookkeepers are expected to have a good understanding of maths and have some experience in an administrative duty. To come to be an accountant, you must have at least a bachelor's degree or, for a greater degree of authority and know-how, you can become a public accountant. Accountants need to also fulfill the strict needs of the bookkeeping code of technique.

The minimum credentials for the CPA and ICAA is a bachelor's level in accountancy. This is a beginning factor for refresher course. This ensures Australian company owners get the finest possible financial guidance and administration possible. Throughout this blog site, we have actually highlighted the huge differences in between accountants and accounting professionals, from training, to functions within your business.

Some Ideas on Baron Tax & Accounting You Need To Know

Accounting firms do greater than just accounting. The services they offer can take full advantage of earnings and support your financial resources. Businesses and individuals ought to think about accountants a crucial component of financial planning. No accountancy company uses every solution, so guarantee your experts are best fit to your certain needs (trusted online tax agent). Knowing where to begin is the initial obstacle

Accounting professionals also can advise customers on making tax obligation legislation benefit them. All taxpayers have the right to representation, according to the IRS. Audit companies can help businesses represent their interests with consultation for submitting procedures, details demands, and audits. A lot of firms do not function alone to accomplish these responses. They function along with attorneys, financial organizers, and insurance professionals to develop a method to lower taxi repayments and avoid costly mistakes.

(https://www.cybo.com/AU-biz/baron-tax-accounting)

Accountants exist to calculate and upgrade the set amount of cash every worker receives routinely. Bear in mind that holidays and illness influence pay-roll, so it's an element of the business that you have to continuously upgrade. Retired life is likewise a substantial aspect of payroll monitoring, especially considered that not every employee will certainly want to be enrolled or be qualified for your firm's retirement matching.

An Unbiased View of Baron Tax & Accounting

Some lending institutions and capitalists call for definitive, strategic choices between the service and shareholders adhering to the meeting. Accountants can also be existing right here to assist in the decision-making procedure.

Little organizations commonly encounter distinct monetary challenges, which is where accounting professionals can give vital assistance. Accountants provide a series of services that help organizations remain on top of their finances and make educated choices. Accountants additionally make certain that companies abide by monetary policies, taking full advantage of tax financial savings and minimizing mistakes in monetary documents.

Thus, specialist bookkeeping aids stay clear of expensive errors. Pay-roll monitoring involves the administration of worker salaries and incomes, tax obligation reductions, and advantages. Accounting professionals make sure that employees are paid accurately and on time. They determine pay-roll tax obligations, take care of withholdings, and guarantee conformity with governmental laws. Processing incomes Dealing with tax obligation filings and payments Tracking fringe benefit and reductions Preparing pay-roll records Appropriate payroll monitoring stops problems such as late settlements, incorrect tax obligation filings, and non-compliance with labor laws.

Rumored Buzz on Baron Tax & Accounting

This step decreases the danger of errors and possible charges. Tiny service proprietors can depend on their accounting professionals to deal with complicated tax codes and regulations, making the declaring procedure smoother and more effective. Tax planning is another important service supplied by accounting professionals. Effective tax preparation involves planning throughout the year to minimize tax liabilities.

Accountants help small organizations in determining the well worth of the firm. resource Approaches like,, and are used. Precise evaluation helps with marketing the business, safeguarding loans, or bring in investors.

Describe the process and answer concerns. Fix any discrepancies in documents. Overview local business owner on finest techniques. Audit support assists companies undergo audits smoothly and effectively. It minimizes anxiety and errors, making certain that services satisfy all necessary regulations. Legal conformity entails adhering to regulations and regulations associated with company operations.

By setting realistic economic targets, organizations can assign resources successfully. Accounting professionals guide in the execution of these techniques to guarantee they straighten with the service's vision. They frequently assess strategies to adjust to transforming market conditions or service growth. Danger administration includes identifying, analyzing, and mitigating risks that could influence a company.

Baron Tax & Accounting Things To Know Before You Buy

They make sure that services comply with tax legislations and industry laws to stay clear of fines. Accounting professionals additionally advise insurance policies that provide defense versus possible risks, making sure the organization is protected against unanticipated events.

These devices aid little businesses maintain accurate documents and improve procedures. is praised for its extensive functions. It assists with invoicing, payroll, and tax preparation. For a cost-free choice, is suggested. It provides lots of functions at no charge and appropriates for start-ups and local business. stands out for simplicity of use.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Brandy Then & Now!

Brandy Then & Now! Danielle Fishel Then & Now!

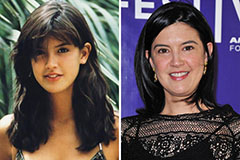

Danielle Fishel Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now!